Downturn? Market meltdown? Market correction? Whatever you want to call it, it's here.

VC and founder perspectives on current economic climate and what you can do now

Hey there,

If you’re reading the news or Twitter, own stocks or simply have been to the supermarket recently you probably noticed: Inflation is real, most tech stocks are in free fall and the economic downturn we heard about now and then since 2020 has finally landed.

If you’re a founder and you planned a funding round any time soon, that’s bad news. If you still have cash in the bank, you are probably reading that you should hold on to it. So what is going on out there and what can or should you do now? I pulled together a few relevant voices in the startup & VC community to help us all navigate this economic downturn. I hope these resources help you to have fruitful discussions with your team on which measures to take.

If you’re not a founder, understanding the current environment, founders and execs are in will help you tremendously to be a more valuable team member and truly support your team and business, going through this:

How to make the most out of the 2022 market meltdown:

💼 LinkedIn: Our plan to navigate tech’s 2022 market correction at Pitch by Christian Reber (CEO, Founder Pitch)

Top Takeaways: Founders need to course correct to get through this crisis smoothly, freezing hiring, reducing costs, doubling down on productivity, being transparent with your team, not adjusting growth targets, but working towards them, be ready to face the worst. To put it in Christian’s words: “It’s […] a chance for founders to increase focus, build more efficient orgs, and take control of their destiny. This moment is a reminder that these are always good goals.”

📰 Medium: The upside of a downturn by Lightspeed Ventures

Top Takeaways: Stay optimistic, but be ready to make hard decisions in order to get through this, review your hiring roadmaps and packages, if you hire, cut non-essentials (testing new marketing channels, entering new geographies, building new stuff just because)

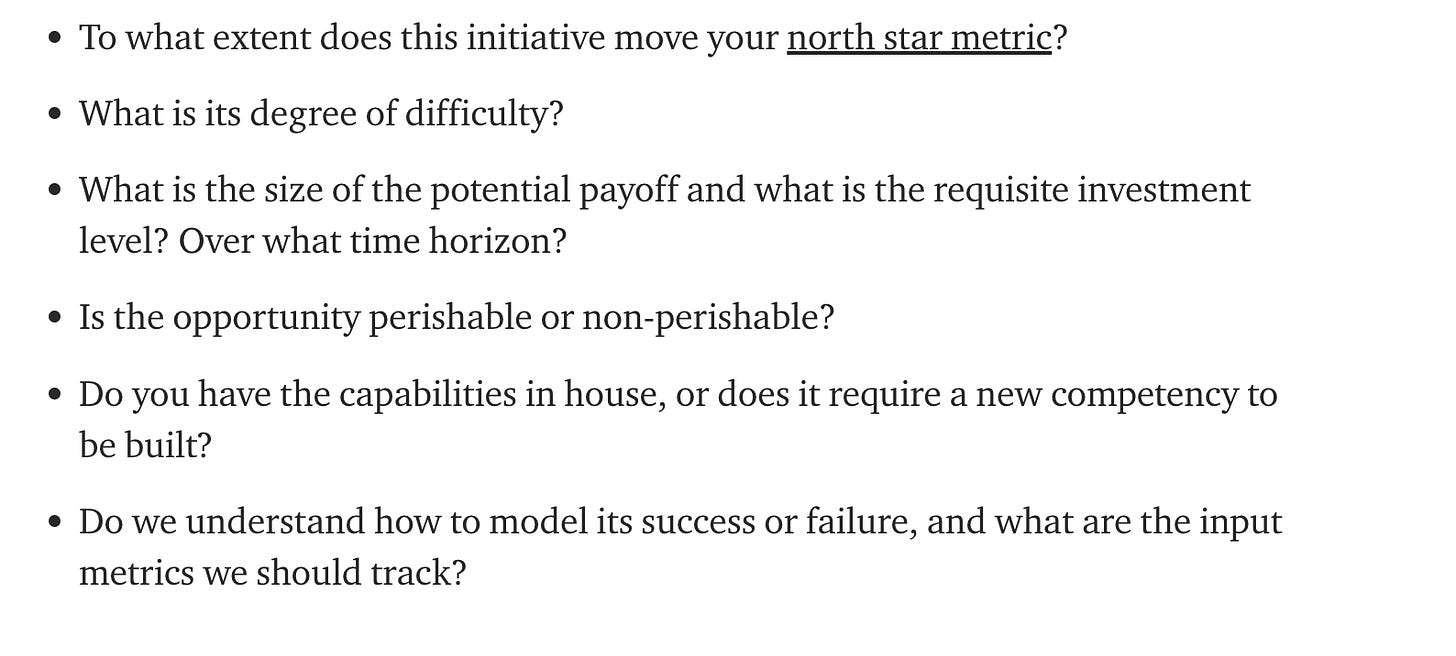

Ask yourself for all your initiatives:

Focus more on profitability than growth. Get to default alive state (read below) within the next 6 months, don’t plan on investors capital for 2022 or 2023.

💼 LinkedIn: Keep Calm by Christian Busch (Founder Ellis Accelerator, & Glass Cube Investments)

Top Takeaways: Later stage funding does not flow right now, seed stage still does, but at lower valuations, Series A is really tricky, crypto VC is holding up, but rumours say that its just a matter of time, tech talent at the MAANGs is moving, since their stocks/options are in a free fall, PE still has cash so there maybe opportunities there, it’ll take time to adjust to new conditions and agree on new valuations, so 12+ months of runway is recommended.

✍🏻 Default Alive or Default Dead by Paul Graham

Top Takeaways: As a founder you should always know whether your company is default alive or default dead 👉 Assuming your expenses remain constant and your revenue growth is what it has been over the last several months, do you make it to profitability on the money you have left? If you’re default dead your job as a founder is to get out of this state as quickly as possible. If you don’t realise it soon enough, you end up in the fatal pinch (see below).

👉 Calculate whether you’re default alive or dead here

✍🏻 The Fatal Pinch by Paul Graham

Top Takeaways: As a startup, as a VC-backed one in particular, you may get into a situation where you still have a few months of runway, but you don’t grow revenues quickly enough and you expect “investors to save you” or you saving the business by raising more money. The issue with that is that as you raise more money, expectations of investors increase, you start burning more money and the company starts to read as “failure” (it can either be a success or failure and the longer you wait to become a success the more you look like a failure). How to get out of it? Try to make more money or decrease your spend. Which typically has huge implications on your team: because you need to reduce or because people need to be pulled into “selling mode” even those that normally write code. You can also consider adding additional revenue streams, aka consulting-ish type of services.

👉 It’s a lot, isn’t it? Easier when discussed with knowledgable peers that are going through the same downturn. Head over to our community to discuss, and get timely advice:

From our community:

Since most of us want to read more but can’t make that happen because we’re all busy and its hard to prioritize reading over other things, we’re piloting the Bunch book club, so you can all achieve your Goodreads annual goals.

Take a look at the book selection below (and who’s hosting each group of the book club) and let us know which group you’d be interested in joining.The rough idea is that we’ll have quick 20 min sessions every 2 weeks or so to discuss 1-2 chapters, with discussions led by our awesome hosts and a dedicated Slack channel.

What you’ll get out of this:

you meet other Buncheeees and learn from and with them

you read a useful book you wanted to read

👉 Let us know which you’d like to join, by voting in the Teams at Work community

We’ll commit to running each group once at least 10 people sign up for the book- so make sure to vote for the book you want to read!

Tips from the Bunch AI Coach:

This week’s tip comes from Marissa Levin, Co-Founder at Successful Culture International, and is reminding us of the simple steps we can take to keep a cool head when crisis hits: The Crisis Checklist.

Hang in there,

Darja

PS: Download the AI coach to get 1% better in just 2 min a day